Successful sports betting takes more than just knowing who to bet on and when to bet on them. The best sports bettors also know how much money to risk on each bet, and the most common method they use to figure that out is the Kelly criterion. Nonetheless, let’s answer the question: what is Kelly criterion?

This betting method was originally developed in the 1950s and was quickly applied to gambling and financial investing. The point of “Kelly” bet sizing is to risk more when your probability of winning is higher and less when it’s lower.

What is the Kelly Criterion? How to Use the Bankroll Management System

Explaining the Kelly Criterion

Let’s say you identify two bets with positive expected value. One is a rebounding prop that wins 60% of the time and the vig is +100, giving it a 20% ROI. The other prop has a 55% chance of winning at a vig of +100 for a 10% ROI. With Kelly betting, you would risk more on the first bet than the second.

The point of doing so is to maximize your return in the long run while avoiding too much risk. On one hand, you could bet a uniform amount on both of those bets and earn a profit that grows your bankroll gradually. That growth would be quite slow with no capacity to compound your returns.

On the other hand, you could find where you have the biggest edge and bet bigger, making the most of your advantage. The problem is that even good bets lose, and sometimes they lose often. A positive expected value bet that connects 65% of the time is going to run up against variance and hit a cold spell. Cold streaks will ruin you if your bet sizing is too aggressive, even if you have a significant edge.

If you are betting 4x your edge, even high +EV opportunities will threaten your bankroll. That’s because the large gains when you hit will be dragged down by the losses.

In the example above, if you have a $100 bankroll, the Kelly bet size recommends betting $10 on a prop with a 55% chance of hitting at a +100 vig. If you make the bet and it loses, you end up with $90. If you did so again, betting 10%– now $9– you would come out at $99, with $1 less than where you started.

Some amount of “drag” is okay, but as your bet sizing grows it can sink your profits. Imagine trying to maximize leverage by wagering $20 instead of $10 — in that case the drag would be $2.

The Kelly criterion is a middle ground that sizes bets aggressively relative to their theoretical edge, while still mitigating your risk of ruin.

The Math Behind the Kelly Criterion

(Odds × Win%) – (Loss%)

——————————–

(Odds)

In the examples above:

#1, 60% win chances, +100 vig,

Kelly bet = [(1*.6)-.4]/1

Wager 20% of your bankroll

#2, 55% win chances, +100 vig,

Kelly bet = [1*.55)-.45]/1

Wager 10% of your bankroll

As you can see, the bet size will grow relative to your win probabilities and the odds

Kelly betting is aggressive when appropriate and allows you to pull back when necessary. That being said, applying full Kelly bet sizes can still be risky. Even the most successful bettors rarely wager the maximum percentages recommended by the formula. It’s common for bettors to divide the Kelly percentage by 2/3 or more to get to a range they are more comfortable with.

For example, somebody betting a quarter Kelly would take every output from the formula and divide it by four. In the cases above, instead of betting 20% of your bankroll and 10%, you would wager 5% and 2.5%. That further limits the risk of going bust as your betting pockets deepen.

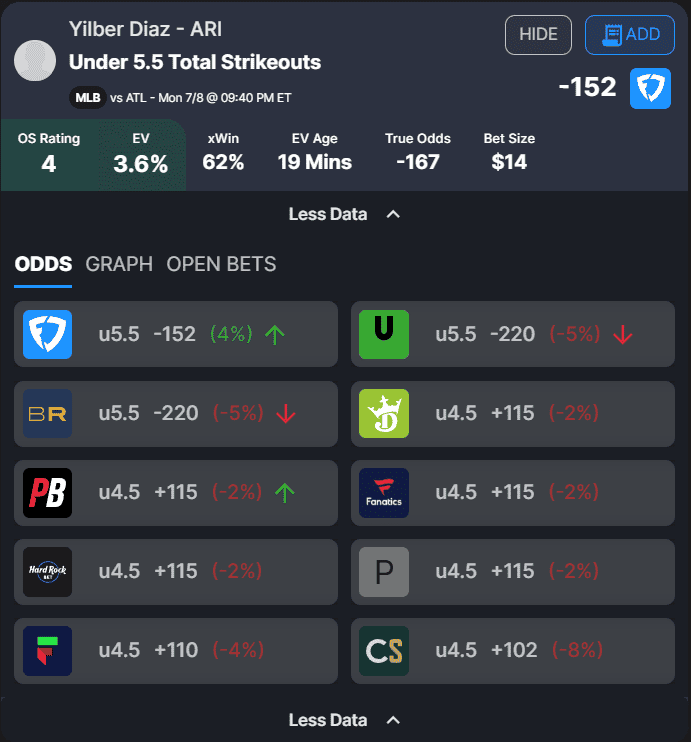

OddsShopper’s Tools Do the Math For You!

Luckily, OddsShopper’s data analysts have done the work for you. Every bet in our tool is listed alongside a metric called bet size, which is quite self-explanatory.

The bet size takes the recommended Kelly bet size and divides it by 2/3. After crunching the numbers, the team found that 2/3 Kelly resulted in the largest ending bankroll in the long run when utilizing the OddsShopper tools. It’s also calculated using a $1,000 bankroll by default, but you can change that number to fit your needs.